Wimbledon 2016 - 2020 Centre Court Debenture Issue

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, JAPAN OR SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

This is an advertisement, not a prospectus. Investors should not subscribe for the 2016-2020 Centre Court debentures referred to below, except on the basis of information contained in the prospectus published by The All England Lawn Tennis Ground plc dated 25 April 2014, which is available to download from www.wimbledon.com/debentures.

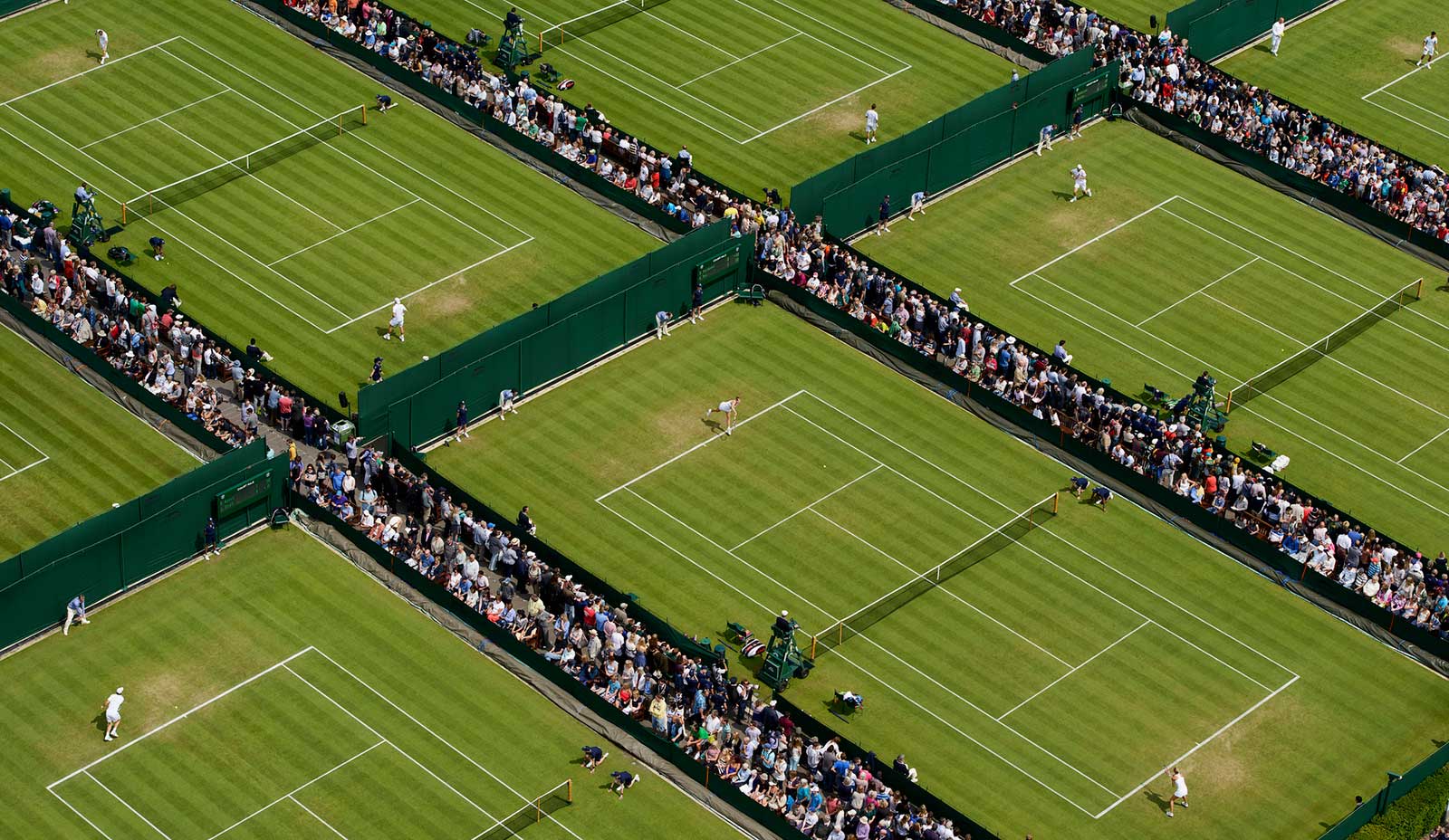

London, UK: The All England Lawn Tennis Ground plc (the “Company”) owner of the tennis courts, Grounds and buildings at which the annual Wimbledon Lawn Tennis Championships (“The Championships”) are held, has announced that it is issuing up to 2,500 Centre Court debentures (the “Debentures”) in relation to the five Championships’ years from 2016 to 2020 inclusive.

Each Debenture has a refundable nominal value of £2,000, and is being issued at a non-refundable premium of £40,000 plus VAT of £8,000, representing a total cost of £50,000 per Debenture.

Subject to the terms and conditions of the Debentures, each Debenture will give its registered holder the right of entrance for one person, free of charge, to the Grounds, together with the right, free of charge, to one Centre Court seat, for each of the days on which play is scheduled to take place at The Championships from 2016 to 2020 inclusive.

In addition, each Debenture will carry, on each day during the 2016 to 2020 Championships, the right of entrance for one person to the private Centre Court debenture holders’ restaurant, bar and lounge facilities.

Debentures were first introduced in 1920 to fund the purchase of part of the Company’s present Grounds and the building of Centre Court. Since then, the proceeds from subsequent debenture issues have provided funding for many significant improvements to the facilities at the Grounds.

The net proceeds of the forthcoming issue will be used to:

- repay the £35 million balance still outstanding on the loan taken out to finance the building of the Centre Court roof; and

- contribute to the early stages of the construction programme resulting from the Wimbledon Master Plan.

Tickets allocated to Centre Court debenture holders are the only Centre Court tickets that are freely transferable and may be sold on the open market. Debenture holders may also sell their debentures on the open market.

Applications are invited for Debentures at £50,000 each payable as follows:

| Amount payable per Debenture | |||||

| Instalment | Date payable | Nominal Value (£) | Premium (£) | VAT* (£) | Total (£) |

| First | 6 June 2014 | 2,000 | 10,000 | 2,000 | 14,000 |

| Second | 30 January 2015 | - | 15,000 | 3,000 | 18,000 |

| Third | 29 January 2016 | - | 15,000 | 3,000 |

18,000 |

| 2,000 | 40,000 | 8,000 | 50,000 |

* VAT has been calculated on the premium at the rate currently in force, being 20.0%. If the rate of VAT changes after the date of the prospectus, the total price payable for a Debenture will change accordingly.

Expected timetable of principal events

| Date for receipt of Application Forms and first instalment | 6 June 2014 |

| Letters of allocation despatched | 23 June 2014 |

| Date for receipt of second instalment | 30 January 2015 |

| Date for receipt of third instalment | 29 January 2016 |

| Refund of nominal value | 3 August 2020 |

Further information on the Debentures and the application process, along with the prospectus which will be available to download, is available at www.wimbledon.com/debentures.

IMPORTANT NOTICES

This press release is not for publication or distribution, in whole or in part, directly or indirectly, in or into the United States, Australia, Canada, Japan, South Africa or any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. The distribution of this press release may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

This press release does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, the securities referred to herein to any person in any jurisdiction, including the United States, Australia, Canada, Japan, South Africa or in any jurisdiction to whom or in which such offer or solicitation is unlawful.

This press release and the information contained herein does not constitute a public offer of securities for sale in the United States. The securities discussed herein are being issued: (i) in accordance with Regulation S (“Regulation S”) under the US Securities Act of 1933, as amended (the “Securities Act”) to persons located outside the United States, excluding US Persons (as such term is defined in Regulation S); and (ii) in accordance with Rule 506(c) of Regulation D under the Securities Act (“Rule 506(c)”), to persons located within the United States and to, or for the account or benefit of, US Persons who qualify as Accredited Investors (“Accredited Investors”, as such term is defined in Rule 501(a) of Regulation D under the Securities Act). This letter does not constitute “directed selling efforts” (as such term is defined in Regulation S) and any person located within the United States or any US Person who participates in the offering must do so under Rule 506(c) as an Accredited Investor and will be required to provide relevant documentation to confirm their Accredited Investor status. The securities discussed herein have not been and will not be registered under the Securities Act and may not be offered or sold in the United States absent an exemption from registration under the Securities Act. No public offering or sale of the securities discussed herein is being made in the United States and the information contained herein does not constitute a public offer of securities for sale in the United States, Canada, Australia, Japan, South Africa or any jurisdiction in which the same would be unlawful. This press release is not for distribution directly or indirectly in or into the United States, Canada, Australia, Japan, South Africa or any other jurisdiction in which the same would be unlawful.

The debentures will constitute “restricted securities” and will be subject to transfer and other relevant restrictions under US securities laws. Investing in these securities does involve risk and these materials are directed only at persons who are able to bear the loss of their investment.

NoSuchKey