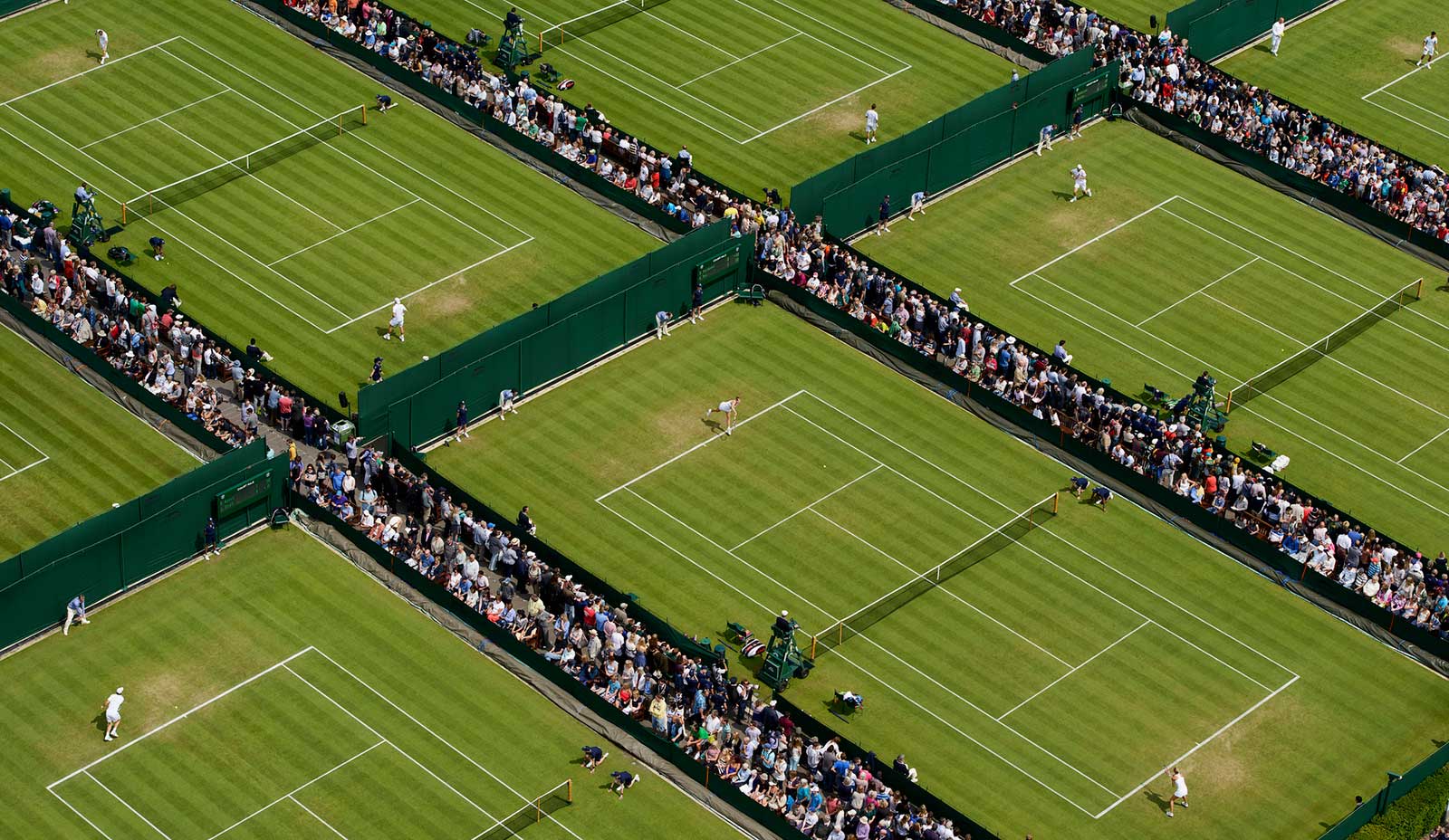

London, UK, Monday 6 June 2016. On 22 April 2016, The All England Lawn Tennis Ground plc (the “AELTG”), owner of the tennis courts, grounds and buildings at which the annual Wimbledon Lawn Tennis Championships (“The Championships”) are held, announced the issue of up to 1,000 No.1 Court debentures for the five years from 2017 to 2021 priced at £31,000 each.

The application period has ended and the AELTG today announces that the issue has been significantly oversubscribed, with renewal rates from existing debenture holders in line with previous debenture issues. Therefore, all 1,000 debentures will be allotted and issued. The debenture issue has raised approximately £25 million (net of VAT and expenses).

The AELTG will shortly notify all applicants as to whether or not their applications have been successful.

The proceeds of the issue will contribute to the funding and implementation of the Wimbledon Master Plan, The All England Lawn Tennis Club’s vision to maintain Wimbledon as the world’s premier tennis tournament. This vision includes the construction of a retractable roof on No.1 Court as well as an extra 900 seats, a new public plaza in the place of Court 19 and new hospitality facilities, all scheduled for completion in 2019.

Advisers to the issue were Rothschild and CMS Cameron McKenna.

-ENDS-

For general media enquiries please contact:

Johnny Perkins, AELTC, + 44 (0)20 8971 2529 or 2443. + 44 (0)7909 975152, [email protected],

Alexandra Willis, AELTC, + 44 (0)20 8971 2730, [email protected]. www.wimbledon.com.

IMPORTANT NOTICES

This press release is not for publication or distribution, in whole or in part, directly or indirectly, in or into the United States, Australia, Canada, Japan, South Africa or any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. The distribution of this press release may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. This press release does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, the securities referred to herein to any person in any jurisdiction, including the United States, Australia, Canada, Japan, South Africa or in any jurisdiction to whom or in which such offer or solicitation is unlawful. This press release and the information contained herein does not constitute a public offer of securities for sale in the United States. The securities constitute “restricted securities” and are subject to transfer and other relevant restrictions under US securities laws. The securities discussed herein were issued: (i) in accordance with Regulation S (“Regulation S”) under the US Securities Act of 1933, as amended (the “Securities Act”) to persons located outside the United States, excluding US Persons (as such term is defined in Regulation S); and (ii) in accordance with Rule 506(c) of Regulation D under the Securities Act (“Rule 506(c)”), to persons located within the United States and to, or for the account or benefit of, US Persons who qualify as Accredited Investors (“Accredited Investors”, as such term is defined in Rule 501(a) of Regulation D under the Securities Act). This press release does not constitute “directed selling efforts” (as such term is defined in Regulation S) and any person located within the United States or any US Person who participated in the offering was required to do so under Rule 506(c) as an Accredited Investor and was required to provide relevant documentation to confirm their Accredited Investor status. The securities discussed herein have not been and will not be registered under the Securities Act and may not be offered or sold in the United States absent an exemption from registration under the Securities Act. No public offering or sale of the securities discussed herein is being made in the United States and the information contained herein does not constitute a public offer of securities for sale in the United States, Canada, Australia, Japan, South Africa or any jurisdiction in which the same would be unlawful.